Business Solutions to Move

Your Business Ahead

Our goal is to provide and equip our members with comprehensive

solutions to help them build winning contractors business.

Value added services

Website Design

There’s simply no denying that businesses with a solid online presence, succeed over ones that don’t.

Gain a competitive advantage to reach more customers and grow your online presence. Small business websites developed specifically for contractors on versatile platforms to help generate more leads and sales.

Optimized for Mobile

65% of digital media is now consumed on smartphones and other mobile devices, while only 35% is spent on desktop computers.

Our responsive websites will improve your search engine rankings and user experience and will align with your social media strategy.

Search Engine Friendly

Even the most beautiful website has little value if potential customers can’t find it.

That’s why our team will develop your custom website with the latest SEO practices in mind, so you’re ranking more prominently for target search terms.

Small business websites developed on versatile platforms help generate more leads and sales.

94% of website user’s first impressions is design-related

75% of users make judgments of a company’s credibility based on its website design.

62% of companies that designed a website specifically for mobile had increased sales

What is the Employee Retention Credit (ERC)?

Business consulting

During our consultation, we will conduct an assessment to determine and uncover your business needs. Based on the findings we will design a plan of action to lay out a pathway that will guide you to becoming a successful contractor.

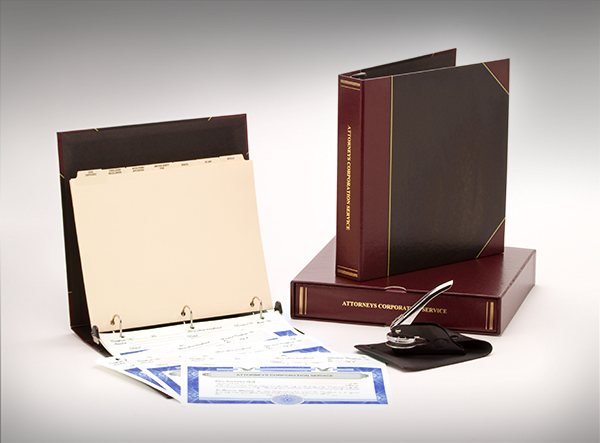

Business formation

Our expert team assists you in getting your contractor business registered in your state. We can help you register your business structure, drafting required paperwork and supporting you through the due process of getting your business registered. Including your EIN#, BIN# & UBI# depending on your state’s requirements.

Top FAQs for Starting a Business

Starting a business can be confusing. Below are the most common

questions we receive from new business owners.

What are the benefits of incorporation?

The main reason to incorporate or form an LLC is to minimize your personal liability. Once your business is incorporated (either by forming an LLC or Corporation), it exists as a separate business entity. Essentially, you put a wall separating your personal assets from anything in the business.

Of course, there are other benefits too. Here are the top reasons to incorporate:

- Minimize your personal liability and protect your personal assets.

- Get more flexibility when it comes to taxes (talk to your CPA or tax advisor for specific advice on your personal situation).

- Boost the credibility of your small business.

- Add a layer of privacy (don’t use your personal name and home address to represent your business).

- Start building your business credit.

- Protect your business name and brand at the state level

What is a Sole Proprietorship?

A Sole Proprietorship is the simplest structure for operating a business owned by one person (or a married couple). By default, states will consider a single-owner business to be a Sole Proprietorship unless the owner (the sole proprietor) files business registration paperwork to form an LLC (Limited Liability Company) or a Corporation. Sole Proprietors are not considered employees of their companies. They get paid by withdrawing funds (taking “owner’s draws) out of their businesses for personal use.

What is a Partnership?

A partnership is a legal entity where two (or more) people run a business. Like a sole proprietorship, each partner owns a portion of the assets and liabilities of the business. The main difference is that a partnership relies on an agreement between the partners. This document, the partnership agreement, details ownership, and responsibilities.

What is a Limited Liability Company (LLC)?

An LLC (Limited Liability Company) is a hybrid of a sole proprietorship/partnership and corporation. This structure is very popular among small businesses, and for good reason. The LLC limits the personal liability of the owners, but doesn’t require much of the heavy formality and paperwork of the corporation. This makes it a great choice for business owners that want liability protection but don’t want to deal with exhaustive meeting minutes, addendum filings or other paperwork you’d need to file as a corporation.

What is a C Corporation?

A “C Corp ” is a standard corporation. It is considered a separate entity from its owners. This means that the corporation is responsible for any of its debts and liabilities. This is often called the “corporate shield” as it protects the owner’s personal assets from debts and liabilities of the business.

A Corporation has a formal structure consisting of shareholders, directors, officers, and employees. Every corporation must select at least one person to serve on its board of directors and officers are required to manage the day-to-day activities of the company.

As a separate business entity, a corporation files its own tax return. As a C corporation owner, you’ll need to file both a personal tax return and a business tax return. In some cases, this can result in a “double taxation” burden for small business owners (see the question on double taxation below for more details).

What is an S Corporation?

An S Corp begins its corporate existence similar to a C Corporation: Articles of Incorporation must be prepared and filed with the state office. Once filed, a “general for profit” corporation has been formed.

Next, the board of directors must meet and resolve to elect S Corporation status. This is achieved by preparing and filing IRS Form 2553 with the IRS. Some states also require a similar filing at the state office before a corporation will be recognized as an S Corporation for STATE tax purposes.

What is a DBA?

Whether that name is legally registered with the business’s home state or not, every business has a legal name. A DBA (or “Doing Business As” is a name that is different from the legal name of the company. A DBA is also referred to as the “trade name,” “assumed business name,” or a “fictitious business name.”

A DBA lets the public know the true owner of a business. DBA laws are consumer protection laws. They exist, so consumers have full transparency on which companies they are transacting business with. In other words, DBAs prevent dishonest business owners from running a company under a different name to avoid legal problems.

What is the difference between a C Corp and an S Corp?

Corporations are subject to double taxation as described above. A C Corporation entity is required to pay tax at the corporate level. An S Corporation is considered a pass-through entity for tax purposes. This means that the company’s profits and losses are passed through to the individual shareholder’s tax return (and each shareholder is typically taxed on the company’s profits based on their share of stock ownership).

Both the LLC and S Corporation structures are taxed on a pass-through basis. Income taxes are paid at the individual owner level rather than at the entity level. Profits and losses get reported on the owners’ personal tax returns.

However, although LLCs and S Corporations are both pass-through entities, there are some differences in how taxes are handled.

- Self-employment tax – Income of an LLC flows to the members involved with the business and is subject to self-employment tax. With an S Corporation, only salaries are subject to self-employment tax. Therefore, any distributions that paid out to S Corporation owners are not subject to Social Security and Medicare taxes.

- Tax flexibility – The LLC offers a lot more flexibility in terms of how owners can be taxed. With an LLC, owners can determine their allocations for the year and be taxed accordingly. With an S Corporation, owners must be taxed based on their pro-rata ownership interests. For example, if one owner owns 50 percent of the business, then that person will be taxed on 50 percent of the company’s profits.

Why do I need to have a Registered Agent?

The Registered Agent must be available Monday – Friday 8am to 5pm at the location specified on your Articles in order to accept service of process. The registered agent’s name and address are public information.

What is a Registered Agent?

LLC’s must designate a registered agent in the state(s) where the company is registered. A registered agent (sometimes referred to as a resident agent) is a person or company officially recognized by the state that resides within the state of incorporation. It is designated by the LLC to accept service of process on behalf of the company. A registered agent may be an individual or another business entity with a physical location in the state of incorporation.

Please note that a post office box or other mail service (e.g., UPS) is usually not sufficient to qualify as a registered agent. The agent is responsible for accepting official notices from the Secretary of State and service of process in the event the corporation is sued.

An LLC’s registered agent must be available Monday through Friday from 8 am to 5 pm at the location specified on the LLC’s Articles of Organization. The registered agent’s name and address are public information, therefore giving some privacy protection to an LLC’s owners.

What are Articles of Organization?

The articles of organization are a legal document containing important information about the business. The Secretary of State office must approve the document for the LLC to be recognized as a legal entity.

Filing articles of organization officially registers the company as an LLC with the state and establishes it as a separate legal entity from its owners (which are called members). That legal separation between owners personally and their business is one of the main drivers for entrepreneurs to form an LLC. In most instances, members are not held liable personally for the company’s legal and financial problems. That gives business owners some peace of mind that their personal assets (e.g., home, vehicles, retirement funds, etc.) will not be at risk if the LLC is sued or cannot pay its debts.

After receiving state approval of its articles of organization, an LLC is considered “domiciled” in that state (i.e., the state becomes the company’s “home” state). The business goes on record as a domestic LLC in the state, obligated to operate according to that state’s laws and codes.

What are Articles of Incorporation?

Articles of incorporation is a legal document containing important information about the company, and it must be approved by the Secretary of State office.

Filing Articles of incorporation registers the company as a corporation (C Corp) with the state. It makes the business a separate legal and tax-paying entity from its owners, giving its incorporators and shareholders personal liability protection from the company’s legal and financial problems.

After receiving state approval of its articles of incorporation, a business is considered “domiciled” in that state (in other words, the state is the corporation’s “home” state). The company goes on record as a domestic corporation in the state, and the corporation must conduct business according to the laws and codes of that state.

Do I need an EIN?

Having an Employer Identification Number (or EIN) helps separate you from your business. If you don’t have one, you will use your social security number on any business licenses, permits, and tax forms. Using an EIN keeps your business at arm’s length.

Getting a Federal Tax ID number is optional if you’re a sole proprietor, but if your business acts as Corporation, LLC, or partnership, you are required by law to have one.

Why do I need an ADA Accessible Website?

What is the AccessiBe WCAG 2.1 ADA Compliance Plugin?

AccessiBe is a game-changer in web accessibility, simplifying and streamlining the process of becoming ADA accessible and compliant using AI, machine learning, and computer vision.

It is the #1 Web Accessibility Solution for WCAG & ADA Compliance

Accessibility compliance explained

Everything You Need to Know About Web Accessibility Compliance & Legislation

As the digital world becomes more essential, lawmakers push for new legislation to enforce an inclusive internet for everyone.

What is web accessibility legislation?

Due to the increased internet usage, many countries have incorporated web accessibility into existing civil rights legislation that protects people with disabilities or created new ones.

How does legislation impact my website?

In 2018, the DOJ clarified that websites are considered places of public accommodation and must comply with ADA Title III. In 2022, the DOJ reaffirmed it and recommended WCAG 2.1 AA as the best practice.

Inaccessible websites face serious legal consequences

With exponential growth in web accessibility, legal actions have a widespread effect across industries, with small and medium businesses in the center.

Lawsuit numbers are estimated to continue to increase as the need to enable accessible digital experiences becomes more prominent.

What happens if I don’t comply?

Compliance is required of businesses of all sizes. Many made headlines in high-profile cases, such as Dominos, Beyoncé, and Kylie Jenner.

|

|

|

|

| How your small business website can get you sued | Smaller businesses are more vulnerable to web accessibility lawsuits | Supreme Court hands victory to blind man who sued Domino’s Pizza | autoNation websites are Not compatible With screen reader software |

| Over the last three to four years, there has been an “explosion” of lawsuits and claims by disabled people… | Settling charges and funding ADA and WCAG compliance can be a hefty sum for most small… | The Supreme Court denied a petition from pizza giant Domino’s to hear whether its website is required to be accessible… |

The plaintiff, a legally blind man from Florida, has sued the company for failure to… |

What is Xpress-Pay?

A powerful online & mobile ePayment system that lets you:

-

- Legally & ethically eliminate ePayment transaction costs.

- Accept payments on your website, on-site, and anywhere else.

- Email customers their bill to get paid faster.

- Accept check payments without a trip to the bank.

- PCI Level 1 certified solution provider, the highest level in the payments industry.

- Pay only $15/month to accept unlimited ePayments.

HOW YOU WIN

| Get Paid Before Heading Out | Increase Revenues | Simplify On-Site Payments |

|

|

|

| With a simple email or text message, your customers can pay you for any job before your technicians ever leave the office. This makes it easier for you to focus on the job at hand, while we make getting paid simple. | Our exclusive Merchant Rewards Program allows you to increase revenues by adding an additional 3% fee (you keep 2%) to every payment. This money can be used to pay your processing costs, or anything else you wish. It’s your money! | Accepting secure, in-person payments has never been easier either. With any mobile device you or your customers can access your dedicated payment portal in seconds to complete transactions. |